When it comes to investing for the long term, few options provide the stability and potential for growth that real estate does. Despite the market’s ups and downs, real estate has consistently proven to be a solid investment choice. In this blog, we’ll explore why real estate still holds the title of the best long-term investment and how it can benefit savvy investors looking for lasting financial security.

1. Tangible Asset with Intrinsic Value

Real estate is a tangible asset that you can see and touch. Unlike stocks or bonds, which are often just numbers on a screen, real estate represents a physical property with intrinsic value. Whether it’s a residential home, a commercial building, or a piece of land, real estate has a tangible presence that provides a sense of security for investors.

2. Appreciation Over Time

One of the most significant advantages of real estate investing is the potential for property appreciation. Historically, real estate values have increased over time, outpacing inflation and providing investors with substantial returns. While there can be short-term fluctuations, the long-term trend has been one of growth. For example, according to the National Association of Realtors, the median existing home price in the U.S. has risen consistently over the past few decades.

3. Passive Income through Rental Yields

Investing in rental properties can generate a steady stream of passive income. By renting out your property, you can earn monthly rental income that can cover your mortgage payments and even provide additional profit. This passive income can be a reliable source of cash flow, especially in retirement, making real estate an attractive long-term investment.

4. Diversification of Investment Portfolio

Real estate is an excellent way to diversify your investment portfolio. By including real estate in your mix of assets, you can reduce risk and improve your overall portfolio stability. Real estate often performs differently from stocks and bonds, providing a hedge against market volatility. This diversification can protect your investments from economic downturns and enhance your financial resilience.

5. Tax Benefits

Real estate investors can take advantage of various tax benefits that can enhance their returns. Deductions for mortgage interest, property taxes, and depreciation can reduce your taxable income and increase your net investment income. Additionally, capital gains tax rates on long-term investments are often lower than ordinary income tax rates, providing further tax advantages for real estate investors.

6. Leverage Opportunities

Real estate allows investors to use leverage to amplify their returns. By using borrowed funds to finance a property purchase, you can control a more valuable asset than you could with your capital alone. This leverage can significantly increase your return on investment if property values rise. However, it’s essential to manage leverage carefully to avoid excessive risk.

7. Inflation Hedge

Real estate is often considered an effective hedge against inflation. As the cost of living rises, so do property values and rental incomes. This means that real estate investments can help preserve your purchasing power over time. Unlike cash, which loses value due to inflation, real estate tends to appreciate, providing a buffer against rising prices.

8. Emotional Satisfaction and Utility

Owning real estate can also provide emotional satisfaction and utility. Whether it’s a family home that becomes a cherished part of your life or a vacation property that offers memorable experiences, real estate can provide personal and emotional value beyond financial returns.

With all the headlines circulating about home prices and mortgage rates, you may be asking yourself if it still makes sense to buy a home right now or if it’s better to keep renting. Here’s some information that could help put your mind at ease by showing that investing in a home is still a powerful decision.

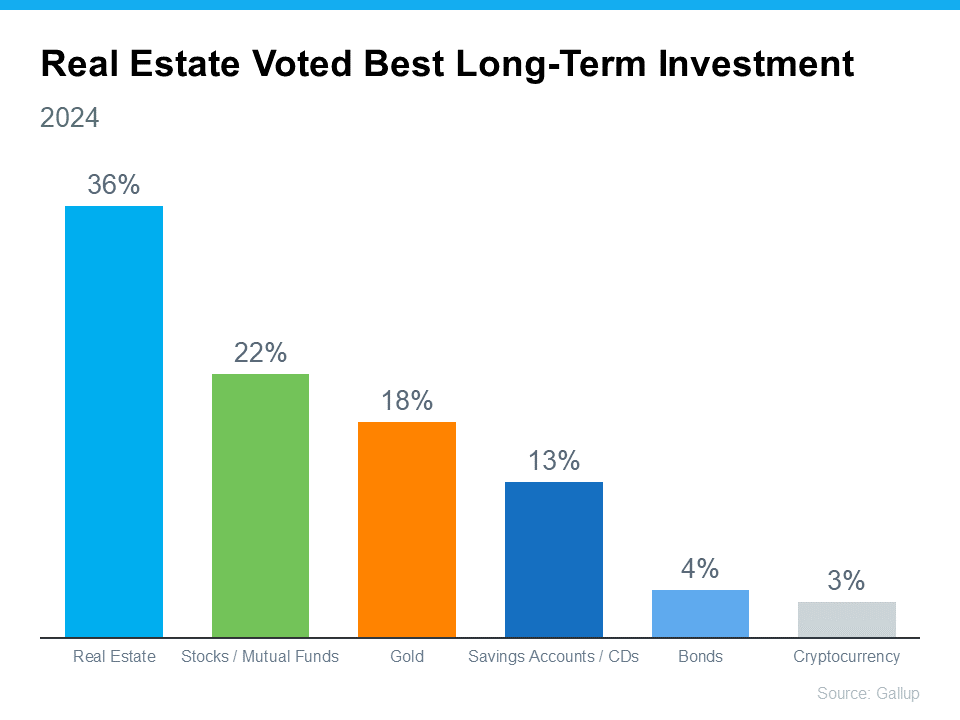

According to the experts at Gallup, real estate has been crowned the top long-term investment for a whopping 12 years in a row. It has consistently beat out other investment types like gold, stocks, and bonds. Just take a look at the graph below – it speaks volumes:

But why does real estate continue to reign supreme as a top-notch long-term investment? Even today, buying a home can be your golden ticket to building wealth over time.

Unlike other investments, which can feel like riding a rollercoaster with all the ups and downs and ongoing risk factors, real estate follows a more predictable and positive pattern.

History shows home values usually rise. And while prices may vary by market, that means as time goes by, your house is likely to appreciate. And that helps you grow your net worth in a big way. As an article from Realtor.com explains:

“Homeownership has long been tied to building wealth—and for good reason. Instead of throwing rent money out the window each month, owning a home allows you to build home equity. And over time, equity can turn your mortgage debt into a sizeable asset.”

So, if you’re on the fence about whether to rent or buy, remember that real estate was consistently voted the best long-term investment for a reason. And if you want to get in on that action, it may make sense to go ahead and buy (if you’re ready and able).

When it comes to building lasting wealth, real estate is the way to go. If you’re ready to start on your journey toward homeownership, let’s connect today.